capital gains tax proposal washington state

Inslee proposed in his 2021-23 budget see Gov. If theyre 250050 you incur a 7 state tax on that extra 50.

The States With The Highest Capital Gains Tax Rates The Motley Fool

The unconstitutional nature of this tax is a long-standing theme with many.

. Critics of the plan have already documented how capital gains taxes substantially increase tax volatility but to many it may not be obvious just how volatile capital gains can be. Continue Reading Governor Dusts Off Washington Capital Gains Tax Idea Proposes Insurance. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to.

June Robinson D-Everett enacts a capital gains excise tax to fund the expansion and affordability of child care early learning and the states paramount duty to provide an education for the. Powerpoint presentation on the proposed Income Tax on Capital Gains from Jason Mercier. Capital gains tax QA 2019-21 proposal This information relates to a capital gains tax as proposed in 2018.

New state tax proposals examined by Jason Mercier. However many sales of assets by a business entity are not capital in nature such as sales of inventory. Here we answer some commonly asked questions about the new tax.

FOR IMMEDIATE RELEASE. Washington Voters to Weigh in on New Capital Gains Income Tax. On November 2nd Washington lawmakers will learn what voters think about it.

The original 9 proposed on capital gains above 250000 for individuals and couples. Washingtons capital gains tax is designed as a direct tax not an indirect one. If we accept the states argument that its an excise tax then its probably an unconstitutional one because it fails to meet the nexus requirements established in cases like Complete Auto Transit v.

At issue is the statewide capital gain tax approved by the legislature and signed by Gov. Prepared by the Department of Revenue. A recent KING 5 poll showed support for the tax.

Washington State Capital Gains Tax Changes in 2021 Updated for 2022 As of March 1 2022 a judge has overturned the new capital gains tax that was implemented beginning January 1 2022. This proposal is effective January 1 2022 with the first capital gains tax return due April 15 2023. Washington capital gains tax proposal gains traction A new capital gains tax would hit couples earning more than 250000 on their investments.

Tina Orwalls D Des Moines estate tax proposal the exclusion amount would be increased to 25 million and the rates for estates over 3 million through 9 million would be increased. The original 9 proposed on capital gains above 250000 for individuals and couples. Senate Bill 5096 sponsored by Sen.

The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. The new law will take effect January 1 2022. Per-Capita Inflation adjusted state spending has more than doubled since 1970s.

SB 5096 would impose a 9 income tax on capital gains in Washington state. One proposal targets new revenue through changes to large estate taxes and the other would tax capital gains above a certain threshold. Jay Inslee in 2021.

Washington Capital Gains Proposal Not Helped by Analogy to Real Estate Excise Tax. Although the ballot measure asking voters to recommend on retaining or repealing the new tax is purely advisory this gauge. On April 24 and 25 2021 the Washington State Legislature approved the reconciled Senate Bill 5096 SB 5096 a measure that imposes a capital gains tax CGT on long-term capital gain income.

Inslees 21-23 capital gains tax proposal QA. The tax measures are contained in the governors two-year 576 billion operating budget proposal released Thursday in advance of the 2021 Legislative session. The state would apply a 79 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

Although the ballot measure asking voters to recommend. The legislation placed a 7. Jay Inslee signed a critical piece of tax reform legislation.

5096 which was signed by Governor Inslee on May 4 2021. Proposed Washington Capital Gains Tax. Washington state Gov.

Jay Inslee on Thursday unveiled a budget proposal for 576 billion in general fund spending and a capital gains tax for the 2021-23 biennium. Proponents of a capital gains tax in Washington have long sought to argue that the tax can be designed as an excise tax rather than an income tax to avoid constitutional constraints imposed on income and property taxation in the state. The judge ruled that this tax was in fact a tax on income that violates the WA State constitution.

It taxes out-of-state earnings and out-of-state activity. Washington State Capital Gains Tax. Washington State Capital Gains Tax Senate Bill 5096 levies a 7 tax on Washington residents annual long-term capital gains exceeding 250000.

Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB. Washington Advisory Vote 37 was a question to voters on whether to maintain the capital gains income tax increase passed by the Legislature during the 2021 session. For example if your annual gains are 249999 no additional tax is incurred.

No capital gains tax currently exists in Washington at the state or local level. Navigating Washington State S New Capital Gains Tax Coldstream Wealth Management. The bill is part of a multi-year push by the legislature to rebalance a state tax system that it calls the most regressive in the nation in Section 1 of the bill by increasing.

This proposal impacts approximately 58000 taxpayers and will impact the state general fund in the following ways. Jay Inslee D signed legislation creating a 7 percent capital gains tax to take effect next year. To see what Gov.

Inslee proposes a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. A warning from France on wealth taxes. OLYMPIA Earlier today Gov.

The first collections under the law would begin in 2023. Separately the Democratic governor also released proposed capital construction and transportation budgets. Among the most controversial elements of the proposal is a proposal that would make Washington the only state to tax capital gains but not impose a general income tax.

Just like at the federal level under the proposed Washington capital gains tax when a pass-through entity sells a long-term capital asset the capital gain would be reported and paid by the entity owners. The Sunday vote on the capital gains bill mostly along party lines primarily targets stock and business ownership sales with a 7 tax for the first time in. On May 4th Gov.

Washington State Enacted Capital Gains Tax Currently Held To Be Unconstitutional 2021 Articles Resources Cla Cliftonlarsonallen

How High Are Capital Gains Taxes In Your State Tax Foundation

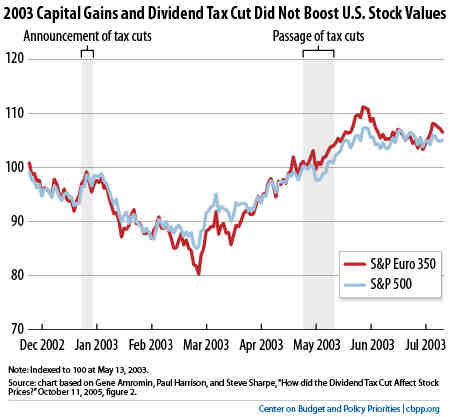

Chart Book 10 Things You Need To Know About The Capital Gains Tax Center On Budget And Policy Priorities

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Controversial Capital Gains Tax Spooks Wealthy Washington Residents As Some Unload Their Stocks Geekwire

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Oregon S Capital Gains Tax Is Too High Oregonlive Com

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Washington State Tech Community Spars Over Proposed Capital Gains Tax Geekwire

House Democrats Tax On Corporate Income Third Highest In Oecd

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

A History Of Washington State S Tax Code All In For Washington

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

Income Tax Increases In The President S American Families Plan Itep

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

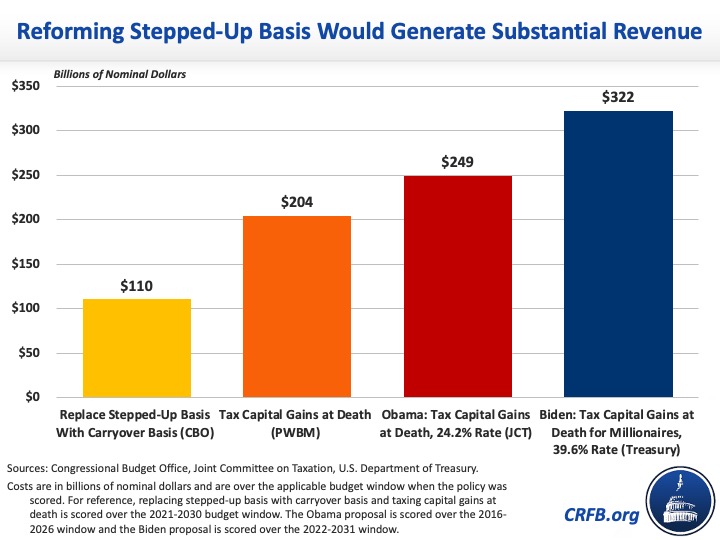

Closing The Stepped Up Basis Loophole Committee For A Responsible Federal Budget